By QUINTON SMITH/YachatsNews.com

The Lincoln County assessor has put into cold, hard figures what anyone who owns or is looking for real estate is thinking about property values.

Wow.

The market value of real estate – especially single-family homes – in Lincoln County increased a whopping 24 percent in 2022 – double the increase from 2021.

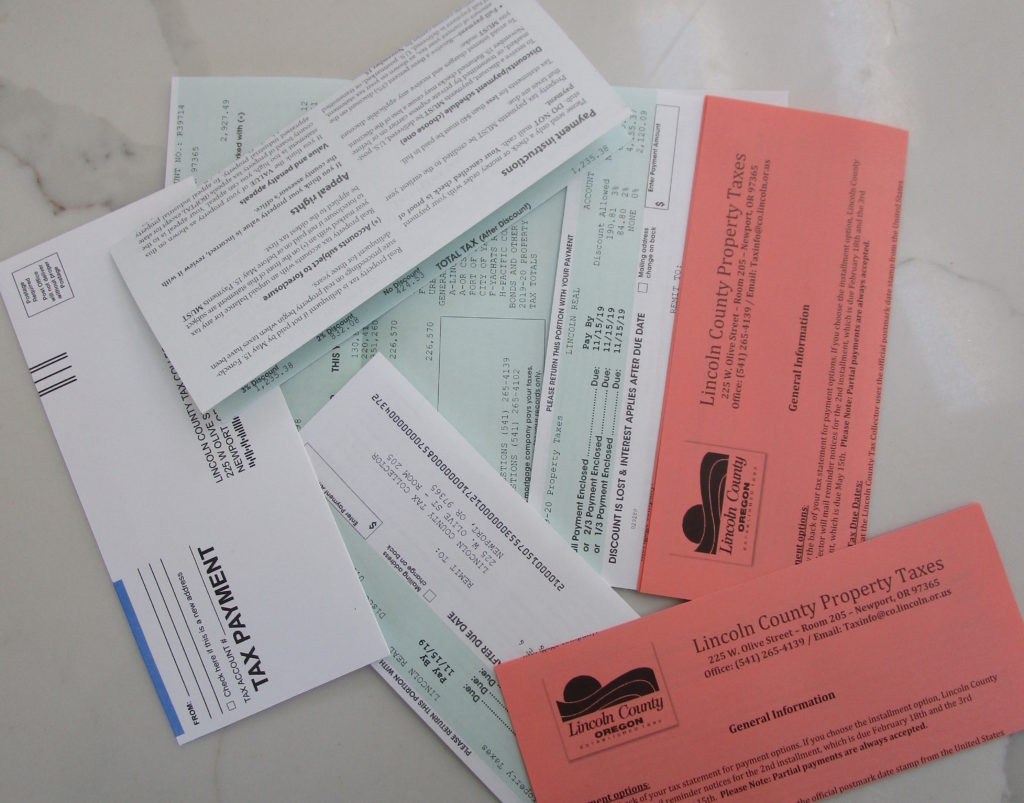

The increase is reflected in property tax statements — but not necessarily bills — arriving in mailboxes this week. The 2022 real market value figure is based on real estate sales in 2021, including residential, multifamily, commercial and industrial.

“It’s definitely the largest increase I’ve seen in my time with the county,” said Lincoln County assessor Joe Davidson, who has worked in the assessor’s office since 2009.

The 2021 real market value increase, based on 2020 sales, was 12 percent.

Luckily, a state ballot measure prevents property taxes from going up that much. Your individual tax bill depends on where you live and what levies or bonds voters approved. Because of a 1997 amendment to the Oregon Constitution, most property tax payers typically see a 3 percent increase in their bills, Davidson said.

Although Davidson and the assessor’s office monitors real estate sales throughout the year, the year-over-year increase is still a remarkable jump. From 2017 to 2020 the increase ranged from 6 percent to 8 percent, Davidson said.

Although Davidson and the assessor’s office monitors real estate sales throughout the year, the year-over-year increase is still a remarkable jump. From 2017 to 2020 the increase ranged from 6 percent to 8 percent, Davidson said.

“The 12 percent increase in 2021 was a big jump, but to see that double again is something,” he said.

The median sales price of a single-family home in Lincoln County increased from $330,000 to $410,000 in 2021, Davidson said.

What is happening this year with sales will reflect in property values or assessments next year. Real estate prices are still increasing, Davidson said, but at a slower rate. And, the number of home sales as of mid-October were 70 percent of what they were for the same period of 2021.

Davidson said the real market value of commercial properties, including lodging and retail stores, increased 20 percent countywide.

“Everything is increasing across the board,” he said.

The countywide assessed (taxable) value increased 4.5 percent for 2022, which reflects the value of new construction and development.

First deadline Nov. 15

Property tax statements – 46,991 of them — were mailed Thursday.

An initial payment is due by Nov. 15. Full payments made by Nov. 15 receive a 3 percent discount and two-thirds payments will receive a 2 percent discount.

For property owners making one-third payments, the second payment is due by Feb. 15, 2023, and the third payment by May 15, 2023.

Payments can be made electronically online, mailed with a postmark on or before Nov. 15, dropped off at a collection box located in the Lincoln County courthouse parking lot, or in person at the tax office located in Room 205 of the courthouse.

Within Lincoln County there are 76 local taxing districts, including education districts, health districts, city, county, port, fire protection, water, road, special assessment districts and urban renewal. All of these have distinct tax rates, and most have different geographic boundaries, so overall tax rates for individual properties vary by location.

Total property taxes, fees and special assessments are up approximately 5.2 percent over 2021. Most property taxes are a product of assessed values and tax rates for the various taxing district levies.

The following are notable levy changes for this year:

- North Lincoln Fire and Rescue District was approved for a new 5-year local option levy with a rate of $1.22 per $1,000 of assessed value. This replaces a previous local option levy of 84 cents.

- Seal Rock Water District’s tax rate for its voter-approved bond is increasing substantially to reflect increased bond repayments. This will result in a tax rate of $1.80 per $1,000 of assessed value, an increase of 76 cents from last year’s rate of $1.04.

Davidson said taxpayers disputing their property values are encouraged to contact the assessor’s office. Appraisal staff will be available to answer questions and review properties for value adjustments up to a deadline of Dec. 31. Taxpayers also have the option to file value petitions to a special appeals board until Dec. 31.

Tax facts:

- County treasurer Jayne Welch said 99 percent of property tax accounts were fully paid in 2021. Historically, 85-90 percent of property taxpayers pay in full by the first installment due date.

- Some 9,419 of the 46,991 property tax statements are paid by banks or other institutions holding the mortgage.

- For 2022, approximately 8 percent of properties in Lincoln County are assessed at their real market value and their owners will see a property tax increase of more than 3 percent;

- According to assessor’s office records, in 2021 about 50 percent of real estate transactions were cash sales, 48 percent of buyers lived in Lincoln County; 33 percent came from elsewhere in Oregon, and 19 percent were from out of state.

A few facts about property tax:

1. Property tax is a wealth tax that every homeowner pays regardless of income

2. Even if you owe the bank 80% (or anything) of your property’s value, you pay tax on 100%

3. If you put in sweat equity to improve your home, you are taxed on the value of your own work

4. Regardless of whether you are on a fixed income like Social Security or a pension, if the value of your property goes up, so do the taxes you pay. Some people are taxed out of their homes.

5. Many county residents are in special tax districts paying for services they do not or cannot feasibly use.

6. The poorest home owners are hit hardest by property tax

7. Because you can’t hide real estate, property taxes are the easiest way for govt to fund schools and pay bond issues for things like fire districts and pools

8. There are other ways to fund government services (income tax, sales tax, value added tax, and more)

9. Is this a criticism or recommendation? No.