Spending by visitors in four northwest Oregon coastal counties has mostly rebounded from the two-year coronavirus pandemic and is expected to fully recover in 2023, according to a new analysis by the Oregon Employment Department.

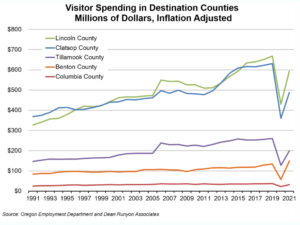

Visitor spending rose to $1.46 billion in northwest Oregon in 2021 – an increase of 46.4 percent from 2020 after adjusting for inflation, according to recently a released report from regional economist Erik Knoder. Despite the rebound, spending was still less than the record $1.73 billion spent in Lincoln, Tillamook, Clatsop, Columbia and Benton counties in 2019.

Visitor spending collapsed by 42 percent in 2020 when the pandemic recession struck and businesses were curtailed that March, the report said.

Visitor spending had been growing about 3 percent per year since 2011 until the pandemic hit in early 2020, Knoder said.

“The region had seen drops in spending before, such as during the Great Recession of 2008-10, but nothing compared to the collapse in 2020,” he said.

Among the five counties, Lincoln County has historically had the most in visitor spending, reaching $600 million in 2021, according to Knoder’s report, after dropping to $430 million in 2020.

Clatsop County was second with just under $500 million in 2021, rebounding from $366 million in 2020.

Almost back at 2019 level

The leisure and hospitality sector’s health depends in large part on spending by visitors, Knoder said, and is considered the best proxy for the tourism industry as a whole.

Visitor spending peaked in 2006 at $1.43 billion and then fell 2 percent the next year. Spending was up and down during the 2008-2010 recession and recovery before climbing steadily from 2012 until the pandemic hit in 2020.

Visitor spending in the five-county northwest region fell 42 percent in 2020 to $998 million, Knoder said, just above the level of 1992.

Benton County had the second-largest drop in visitor spending – minus 57.2 percent — of all counties in Oregon in 2020. But the county bounced back dramatically in 2021 with visitor spending increasing 158 percent to a record $148 million. The drop and recovery are probably due to changes by students at Oregon State University; in-person attendance was suspended in 2020 and resumed in 2021.

The other counties in Northwest Oregon saw visitor spending increase sharply in 2021, Knoder reported, but not quite recover to pre-pandemic levels.

One quarter of county jobs

Leisure and hospitality provided 14,906 payroll jobs on an annual average basis in 2021, Knoder said, about 16 percent of all payroll jobs in Lincoln, Benton, Clatsop, Columbia, and Tillamook counties combined.

In Lincoln County, there were 4,620 people employed in the leisure and hospitality industry in October, according to the agency, 25.6 percent of the county’s total nonfarm workers.

Employment in the leisure and hospitality sector tends to parallel visitor spending. It’s improving rapidly but is still not completely recovered, except in Benton County.

Employment in the five counties in northwest Oregon dropped an unprecedented 54 percent from March to April in 2020.

Employment has been growing since then. In September 2022 it was 8.6 percent higher than the year before, but it remained 1.2 percent lower than in September 2019 – the last year before the pandemic recession.

It seems likely that the sector will continue to grow in the longer run and its employment will return to pre-pandemic levels by next year, Knoder is forecasting.

“In fact, there is some reason to think that the main constraint on employment growth in 2022 was the tight labor market, not lack of visitor spending,” he said. “Job vacancy surveys showed that there were more job openings than people who were unemployed in 2022.”

The long-term outlook for visitor spending is good. The leisure and hospitality sector’s employment in Northwest Oregon is expected to grow 44 percent from 2020 to 2030. Most of that growth is based on the expectation that the sector recovers to its former level. After that, the sector’s employment will probably grow at a little less than 1 percent per year.

A major unknown factor will be how the pandemic recession and subsequent tight labor market will affect the sector’s adoption of labor-saving technology and business practices, Knoder said. “Businesses may be more likely to implement service models, such as takeaway food, that allow them more flexibility in adapting to any future pandemic,” he said.