By QUINTON SMITH/YachatsNews.com

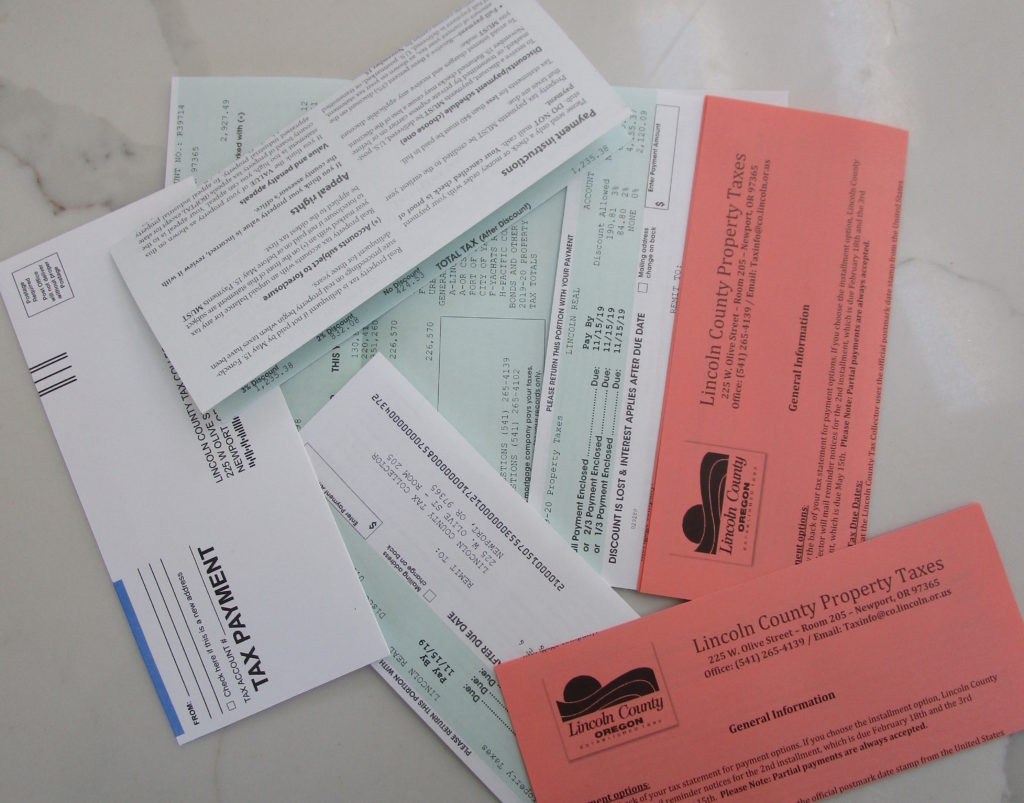

You should have gotten that dreaded bill this week – your annual property tax statement from Lincoln County.

The Lincoln County Assessor’s Office this week mailed 49,000 property tax bills. Now you have three weeks to start paying – or to call the office if you have questions.

“It’s always a busy first week,” said Joe Davidson, county assessor. “The first few days we get bombarded with questions. But that’s what we’re here for.”

During this busy time Davidson keeps all the department’s field staff in the office to respond to questions – either on the phone or over the counter.

“If anyone has questions we’re here,” he said, cautioning for a little patience as calls tend to pile up.

Overall, real market value in Lincoln County is up approximately 9 percent from 2018, Davidson said, while countywide assessed (taxable) value has increased about 4 percent. He expects that trend to continue next year.

In Yachats, real market value increased a bit more — 9.8 percent.

Those are 50 percent higher rates than the 6 percent increases in real market values the county experienced in 2016, 2017 and 2018, Davidson said.

The percentages reflect the value of new construction and development.

Most property owners will see a typical 3 percent increase in their assessed value due to Measure 50 – a constitutional amendment approved by Oregon voters in 1997.

Initial payments are due by Nov. 15. Full payments made by Nov. 15 receive a 3 percent discount and two-thirds payments receive a 2 percent discount.

Davidson said two-thirds of accounts are paid by Nov. 15, including 9,000 paid automatically by banks holding a taxpayer’s residential mortgage.

At least one-third payment must be received by Nov. 15 to avoid delinquent interest charges. For people making one-third payments, the second payment is due by Feb. 15, 2020, and the third payment due by May 15, 2020.

Tax payments can be made electronically through the county website, mailed with a postmark on or before Nov. 15, dropped off at a payment box located in the county courthouse parking lot, or in person at the tax office located in room 205 on the second floor of the county courthouse.

Payments are no longer being processed at Newport-area banks.

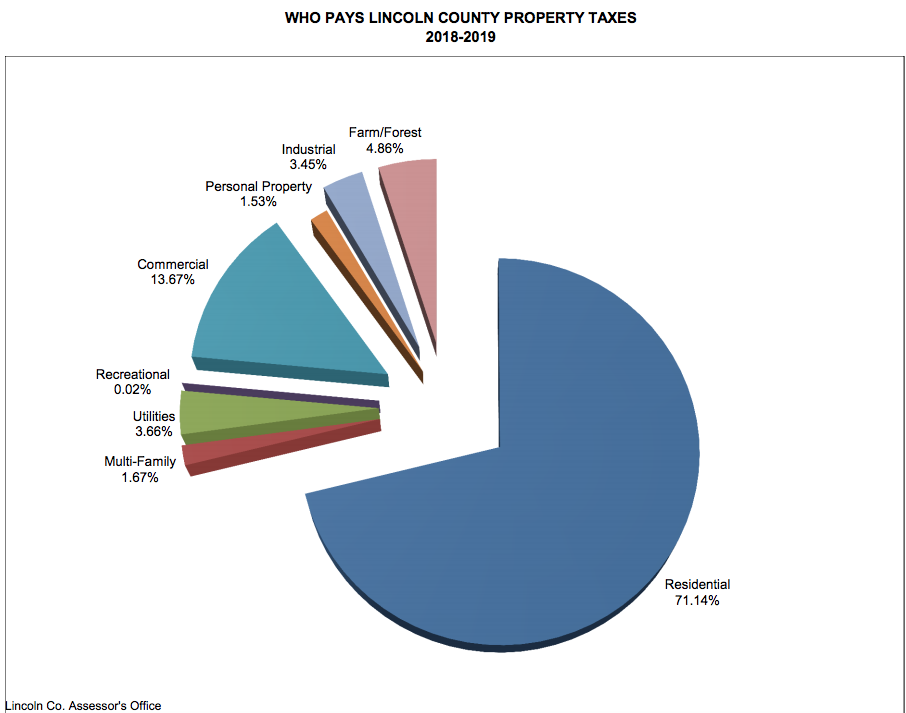

Davidson said there are 75 local taxing districts in Lincoln County, including education districts, health districts, city, county, port, local fire, water, road, special assessment districts and urban renewal districts. All of these have distinct tax rates, Davidson said, and most have different geographic boundaries, so overall tax rates for individual properties vary by location.

Total property taxes, fees and special assessments are up approximately 3.4 percent over last year, Davidson said.

Most property taxes are a product of assessed values and underlying district tax rates. Along with changes in assessed values, new voter-approved levies may impact total taxes in certain areas of the county. This year, just two local options levies were approved in the county. One of those was a renewal of a five-year local option levy for the Yachats Rural Fire Protection District of 59 cents per $1,000 assessed value. Because it was a renewal, there was no tax rate change.

And for the second year there were no school, hospital district, port or fire district bonds approved by voters this past year.

Tax statements will display total amounts imposed by individual districts, along with current and prior year property values. Values for both years are categorized by land, structure, total real market value and total assessed value.

Taxpayers disputing their property values are encouraged to contact the assessor’s office. Appraisal staff will be available to answer questions and review properties for value adjustments up to Dec. 31.

Davidson said a common misperception is that property owners have to file an appeal in order to get an adjustment.

“There are more options than to just appeal,” he said. Davidson said people can work with the assessor’s staff to get data to show real market data or to correct errors and possibly do value reductions by Dec. 31.

In 2017 the Board of Property Tax Appeals heard 130 appeals; last year it was half that, Davidson said.

“We work with people on this,” Davidson said. “We’re really trying to get that message out there. We’re not always going to agree, but if there’s a good, competitive sale (as a comparable) then we can generally work things out.”