By QUINTON SMITH/YachatsNews.com

As expected, the major motel managers in Yachats told the City Council Wednesday night that their idea to raise the city’s lodging tax by 11 percent was the wrong way to support tourism and prop up the city budget.

Instead, they asked for a better long-term plan for using tourism taxes, to bring more people to Yachats in the off season, and to set up a special committee involving business owners and others to oversee tourism-funded projects.

They also reminded the council that, coupled with a 5 percent food and beverage tax, Yachats has by far and away the highest tourism taxes on the Oregon coast.

“Our guests are more informed than ever,” said Anthony Muirhead, general manager of the Adobe, which has 110 rooms and two restaurants. “If or when the economy slows our guests will become even more informed … and it will be a scary thing if Yachats is the most expensive place on the coast to visit.”

No one testified Wednesday night in support of the increase.

The council is proposing to raise the city’s transient lodging tax by one percentage point — from 9 to 10 percent, an 11 percent increase. The state also tacks on a lodging tax of 1.8 percent, so if approved Yachats’ total lodging tax would be 11.8 percent.

The city is also one of two in Oregon – the other is Ashland – to levy a 5 percent tax on food and beverages sold in restaurants or prepared food from grocery stores.

The council is looking for more money – an estimated $115,000 a year from the proposed increase – to fund tourism-related projects in need of cash and to help next year’s budget. The current operating budget is $1.7 million.

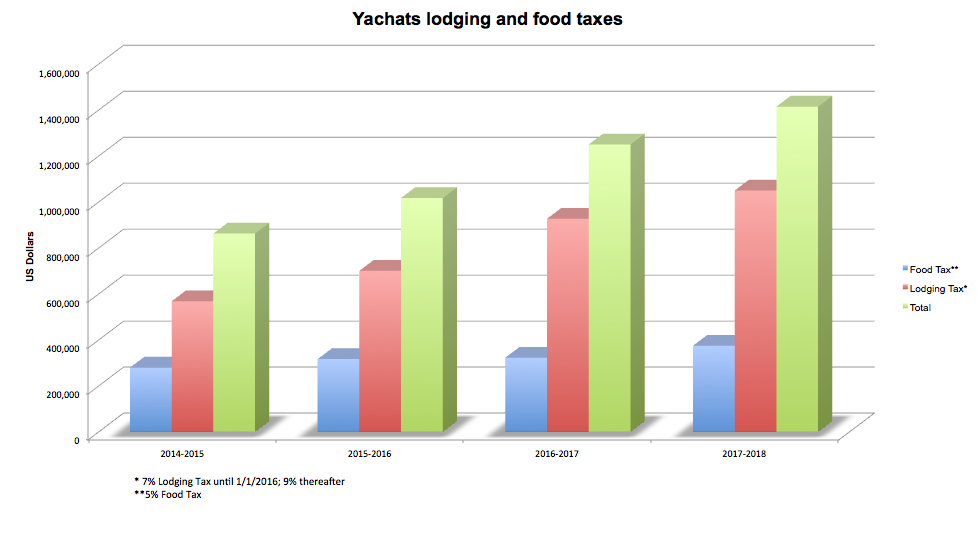

During the 2017-18 fiscal year Yachats collected $1.04 million in lodging taxes and $375,000 in food and beverage taxes. Motels contribute about 75 percent of the lodging taxes; vacation rentals the remaining 25 percent. The food and beverage tax is used almost exclusively to pay for expansion of the sewage treatment plant.

That revenue has almost doubled in the last five years as tourism and motel rates increased, vacation rentals grew and after the city raised its lodging tax from 7 percent to 9 percent in 2016.

Before 2016 local governments were required to use 30 percent of lodging taxes on broadly-defined tourist-related activities; the other 70 percent could be used for yearly operations. That formula flipped in 2016 with 70 percent of any tax increases going to tourist-related activities and 30 percent for general government operations.

Under that 30-70/70-30 formula on a 9 percent tax, Yachats currently uses about 60 percent on general fund expenses and 40 percent on tourist-related activities.

Linda Heltzer, owner of the Drift Inn and president of the Yachats Chamber of Commerce, said the chamber is opposed to any tax increase. Instead, she proposed “embarking on a rigorous effort” to find specific, targeted uses of tourism taxes to bring more people to Yachats in the off season.

“We would like the city to work with a task force that would determine the best way to spend visitor amenities dollars for a period of two years and then revisit increasing the tax at that time,” she said.

Heltzer also contended the city could do a better job of collecting lodging taxes from third-party agencies, although unsaid, like Airbnb and VRBO/HomeAway. According to her conversations with third-party bookers, Heltzer estimated that could amount to $75,000 a year.

Yachats has $203,000 in its current budget for tourism-related projects, including money for the library, Little Log Church Museum, the Commons, trails, new signs for the entrances to the city, and apportioned costs for professional services, maintenance and equipment. The budget also has $133,000 for marketing, including $65,000 to operate the chamber-run visitors center, professional services and city beautification. The budget also has $200,000 to acquire and pave a city parking lot and a reserve of $119,000.

Drew Roslund, partner in the Overleaf and Fireside motels, said the city’s combined lodging and food taxes of nearly 16 percent puts Yachats’ businesses at a competitive disadvantage. He also said the city has to “figure out how to live” on the 56 percent increase in unrestricted tax revenue it has seen since 2014.

“We’re already relying on the tourist enough,” Roslund said. “To hit them even more is difficult to justify.”

He also called for a community group to specifically oversee how tourist-related taxes are spent. The city’s finance and budget committees, even with new appointments Wednesday night, have no business owners or business representatives on them.

Roslund questioned the city’s use of lodging taxes on the library and parks or trails not along the ocean. He worried about the massive cost – an estimated $250,000 to $300,000 – to rehabilitate the Little Log Church and Museum and said his informal survey on the TripAdviser website had it ranked low among Yachats-area attractions.

“I would support plans for the Little Log Church if it was made a tourist-related project and became a tourist destination,” he said.

Jamie Michel, operations manager for Sweet Homes Vacation Getaways, said vacation rental owners would be OK with the tax increase if the city would increase the 125-license limit it put on the number of vacation rentals nearly two years ago. She said she is a member of a transient rental tax task force in Newport and offered to help set one up in Yachats.

Council members listened but asked no questions of speakers during the hour-long hearing. Mayor John Moore, who pushed the proposed tax increase through the finance committee last year, said the people testifying had given the council “a lot to think about.”

No date was set for when the council would next discuss or decide the tax.