By DANA TIMS/YachatsNews

When it comes to coastal real estate, industry veterans are always trying to spot new influences capable of roiling a market that seems perpetually unstable.

There are plenty of those afoot these days, they say, including rising insurance rates, the likely cut later this month of the federal interest rates that will affect home mortgage rates, and new rules governing how real estate agents are compensated.

“I’ve been in this business for 36 years now,” said Tammy Gagne, a broker in Advantage Real Estate’s Newport office. “And the one constant is that things are always changing.”

The constant churn of the market is easily enough to keep both buyers and sellers confused and often unsure of their next best steps, she said.

But, broadly speaking, some trends are emerging that make today’s market very different from, say, a few years ago, when increasing demand and scarce inventory often resulted in new listings receiving multiple offers the first day.

“Each town on the coast is a little different,” Gagne said. “But right now, the gauge is sitting smack dab on the line between being a buyers’ and a sellers’ market. Right in the middle.”

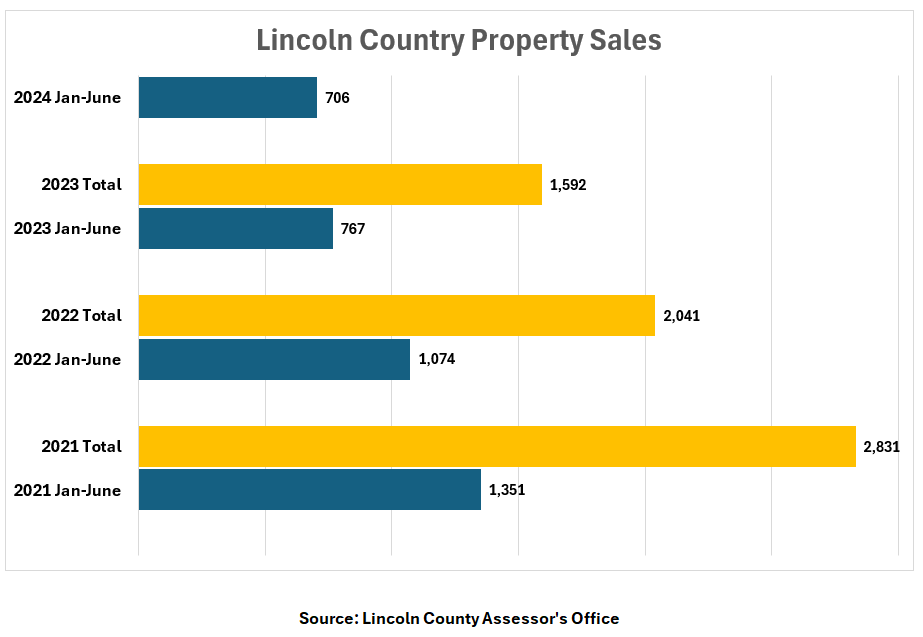

The effect of that new balancing point is that houses are tending to remain on the market for longer periods than, for instance, in 2021, when 2,831 total property sales were recorded, according to the Lincoln County assessor’s office.

That number dipped to 2,041 in 2022 and still further to 1,592 in 2023. The number for 2024, based on the 706 recorded sales from January through June this year, is on track to be even lower by year’s end compared to each of the past three years.

For sellers, those longer wait times on the market are translating to price reductions, although not by anything startling, Gagne said.

“With fall, then winter, coming on, sellers are saying, let’s try a $10,000 drop, or maybe a $20,000 drop,” she said. “If things are still sitting into the fall, that’s where we’ll be seeing price reductions.”

Differing experiences

Exactly who is looking to buy a house in Lincoln County right now includes first-time buyers with access to financing, retirees and former 35-year-olds who are now 45 and want to upgrade, said Robert Haselhuhn, a broker who divides his time between Emerald Coast Realty’s offices in Seal Rock and Yachats.

“We also see plenty of 65-year-olds who are looking to downsize into something more manageable,” he said. “And generally, those categories are always here on the coast. For every one person who wants to leave for somewhere else, there is someone who wants to finally achieve their dream of moving to the coast.”

Pinpointing where the market is hottest remains an elusive goal, says Haselhuhn. Anytime someone asserts that a listing price of, say, $450,000 is the new sweet spot, Haselhuhn will get a client looking for something in the $800,000 to $1.2 million range.

“So you just never know,” he said. “It really depends on that person’s needs and budget. It’s really all over the map.”

A lawsuit, new regulations

Real estate, for buyers, sellers and brokers, is a challenging business even on the best days, veterans say.

But an entirely new level of uncertainly is now spreading across the market in the wake of the National Association of Realtors’ decision to settle a series of class-action lawsuits alleging that its compensation methods amounted to antitrust practices.

The bulk of the settlement, which resulted in the association having to pay more than $400 million in damages, went into effect last month in most parts of the country, including Oregon.

The settlement requires buyers to have signed contracts with brokers before touring a single house. Sellers, for their part, will no longer automatically cover the costs of agents’ fees for buyers.

The days when real estate brokers in the Willamette Valley could call their coastal counterparts and ask them the favor of showing a house to a client are long gone. Now, a signed contract between that broker and buyer would need to be in place, and the broker would have to drive to the coast to show the house in person.

To call it a shakeup is an understatement, Gagne said.

“Buyers are confused,” she said. “Sellers are confused. And over half the brokers I talk to are confused. It’s a bit of a mess.”

Traditionally, agents working with a buyer and seller split a commission of between 5 percent and 6 percent that’s paid by the seller. The practiced produced built-in offers of “cooperative compensation” between agents on both sides.

“One thing we’re seeing is an early trend of sellers saying, ‘We don’t have to pay this fee so we’re not going to’,” said Joanne Biron, a broker in Emerald Coast Realty’s Waldport office. “What’s clear is that a lot of education has to take place to let everyone know just what’s going on.”

She is confident, however, that a little time and experience with the new regulations will be smoothly ironed out.

“It happened so quickly that it left a lot of people scrambling,” Biron said. “Moving ahead, it’s going to be all about negotiating exactly who needs to pay what.”

The assessor’s view

From Joe Davidson’s seat as Lincoln County assessor, the county’s real estate market right now is remaining stable.

The overall volume of sales currently is about 35 percent less than it was two years ago, he said, while real market values are media home-sale values are continuing to climb at slow, but steady, rates.

In 2013, for instance – the year values finally started to increase following the 2008-09 collapse of the nation’s real estate market – the county’s median home-sale value sat at $187,000, according to figures from Davidson’s office. Less than a decade later, in 2022, that figure had rocketed to $490,000.

“That’s quite a jump,” he said.

The same figure dipped to $450,000 in 2023, but Davidson said he expects it to keep climbing at a somewhat slow and steady pace.

As for who is buying houses in Lincoln County, the assessor said questionnaires his office sends out following successful sales shows that upwards of 50 percent of all new sales go to those already living within the county. Another 30 percent go to people living elsewhere in the state, with the remaining 20 percent of sales going to people living outside Oregon.

“Of course, there were so many sales that weren’t reported because those questionnaires just weren’t returned to us,” Davidson said. “So that could certainly skew some of those figures.”

Overall, he added, the market’s current stability is exactly opposite of what occurred after the last recession 15 years ago.

“We’re always looking to identify new trends,” he said. “But based on the data, things are looking pretty smooth.”

- Dana Tims is an Oregon freelance writer who contributes regularly to YachatsNews.com. He can be reached at DanaTims24@gmail.com