By DANA TIMS/YachatsNews.com

Small, older houses selling for one million dollars after only days on the market. Bidding wars. Multiple offers. Local residents completely priced out of the picture.

And behind it all is the simple fact that Economics 101 is driving a real estate frenzy the likes of which even longtime industry professionals have never seen in Lincoln County or elsewhere.

“It’s basic supply and demand,” said Freddy Saxton, a principal broker in Advantage Real Estate’s Newport office. “A drastic shortage of houses, combined with overwhelming demand to buy a place here, is creating something we’ve just never experienced before.”

The demand side of that equation is fueled largely by out-of-state buyers whose sales of their previous houses in high-market states such as California, Arizona, Missouri and even Portland, has left them brimming with cash, Saxton said.

“I have a lot of area clients who sold their little ranch house in Los Angeles for $2 million, leaving them free to outbid so many others here,” he said. “Prices we’re seeing are kind of crazy for what we’re accustomed to, but what can you do?”

A prime example of that trend just played out in Yachats, when a 62-year-old two-bedroom, two-bath oceanfront house along Ocean View Drive went on the market. Lincoln County Assessor Joe Davidson’s office, using 2021 sales data, put the preliminary value for the property at $606,000.

But, given its location, buyers sprang. Within two days, two bids above the $1.2 million asking priced rolled in. The sale is now pending, with closing expected to take place in less than two weeks, said Alishia Smith, the Coldwell Banker Realty agent who handled the listing.

“To be fair,” she said, “this is a unique property. It has access to a private beach and is fronted by basalt rock, which will help with erosion.”

Still, she added, “Almost every property that comes on the market has competing offers. People wanting a house on the coast are facing 10 to 12 offers from others. It’s really the wild west right now.”

The day after that sale closed, another, larger and far newer house – this one located on East Third Street overlooking downtown Yachats – hit the market with a $1.2 million asking price.

Industry veterans say more of the same can be expected as new houses trickle onto the market.

“Even seven years ago, we would see one or two million-dollar residential sales in Lincoln County in an entire year,” Saxton said. “We are now seeing one or two every week. It’s scary.”

Lots can be hot sellers too

Inside the Yachats city limits, there have been an average of 10-15 new homes constructed each year since 2018. In 2021, the city handled building permits for 13 new single-family homes and two manufactured dwellings.

That, in turn, has led to high demand for building lots – even in the Blackstone subdivision high on Horizon Hill that went into bankruptcy in the last housing crash. In 2021, according to the county assessor’s office, 32 view building lots changed hands.

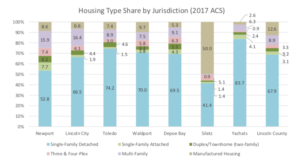

The demand for housing — especially for coastal workers — led the cities of Waldport and Yachats to commence a year-long look at what types of housing and property is available in their cities and what possibly to do to increase inventory.

The high demand for building lots — even ones in hard-to-develop places — led developer Layne Morrill of Yachats to put eight lots in his Creekside planned unit development back on the market.

Morrill, who has developed low-income housing in Yachats, pulled the lots off the market in 2009 during the last housing crash.

“We just told ourselves to forget about it until things turned around,” he said. “Now, it’s time to put them back on the market.”

The lots, on steep hillsides along Chief Albert Drive and Creekside Lane above the Yachats Cemetery, have all utilities installed and include access to five acres of common areas and trails. Houses will need extensive foundations because of the location, so the ocean-view lots are priced from $109,000 to $159,000.

“We’d rather get them sold than try to go for top dollar, Morrill said.

The issue of “affordable” housing

The escalating cost of houses is just one element of a persistent lack of affordable housing in Lincoln County and the coast.

The shortage of affordable housing in the area has grown worse the past two years, compounded by the coronavirus pandemic’s effects on work and jobs, an influx of new residents, the high prices that the sale of second homes and rentals are now fetching, and the continual struggle by local, mostly small contracting companies to build enough medium-priced houses on a scarce number of lots.

Planners and stakeholders from throughout Lincoln County spent more than a year studying housing issues, completing a report in 2019 that outlines the problems and possible steps toward a partial solution. While it’s been three years since the report, the situation has only grown worse.

The report identified four main themes, including:

- There is a need for all types and prices of housing in the county, but the pressure to keep rents low means that multifamily housing is unlikely to be built without a subsidy;

- Constrained by the ocean to the west and hills to the east, most coastal communities have issues with the supply of land, much of which is difficult or costly to serve with septic systems, sewers or roads because of steep slopes or wetlands;

- Builders in Lincoln County are constrained by high labor costs and low worker availability, and the higher cost of building on the coast and generally smaller projects do not attract builders from the Willamette Valley.

- The need to determine whether the estimated 2,100 vacation rentals in the county have an effect on prices and availability of affordable homes.

The study outlined at least nine steps or ideas that could help address the housing issue, including:

- Having cities update their comprehensive plans for development;

- Local governments should resume home rehabilitation loans or grant programs;

- Institute a tax on new construction dedicated for affordable housing, similar to that the current school excise tax;

- Have the Oregon Legislature reallocate some lodging taxes to affordable housing, which has historically drawn opposition from the lodging industry;

29 percent increase in prices

Across the so-called North Coast region – comprised of Lincoln, Clatsop and Tillamook counties – average residential property sales are soaring, according to recent data published by the Residential Multiple Listing Service.

Prices, based on a 12-month moving average, rose 29.2 percent in January to $543,700, according to the data. That far surpassed the 13 percent hike in Columbia County and the 18.2 percent increase in Benton County.

“No doubt, it’s all kind of amazing,” said Erik Knoder, a regional economist for the Oregon Employment Department whose research focuses on northern coastal counties.

If there is any relief in sight, at least for potential buyers, it may come in the form of rising interest rates now being imposed nationally in the federal government’s attempts to slow the pace of inflation, Knoder said.

“Rates going up mean you can’t afford the same house you could six months ago,” he said. “At the very least, rising interest rates will slow down the pace of increases in prices.”

In the estimation of some experts, however, it could take years to add enough new inventory to bring the market into anything resembling balance between buyers and sellers.

“A lot of people would no doubt love to take advantage of these prices and sell their homes,” said Joni Biron, a broker in Emerald Coast Realty’s Waldport office. “But unless they wanted to relocate somewhere else, it’s highly unlikely they would be able to turn around and buy anything else around here. So they’re left with no place to buy and nowhere to go.”

First-time homebuyers, facing current costs, find themselves completely frozen out of the real estate market, Biron said.

“And even someone who sells a fairly modest house can’t turn around and buy anything decent for under $400,000,” she said. “I’ve had people tell me they’ll just wait until prices fall but, honestly, I don’t they’re going to. Not any time soon, anyway.”

Joan Davies of Yachats, a broker at Advantage Real Estate, is among the many in the industry who has never seen conditions like this.

As an example of the volatility now roiling the market, she cited a 1942-era duplex adjacent to Yachats State Park that she listed in October with an asking price of $549,000. Within three days, nine offers poured in, all over listing price. It sold Oct. 14 for $605,000 – in cash.

“For whatever reason, it was back on the market three weeks ago,” Davies said with a list price of $750,000. “Nothing about the duplex had changed. No remodeling. No one had even lived in it.”

Countywide, overall sales that took place in 2021 showed a 15 percent increase in real market value, Lincoln County assessor Davidson wrote in response to questions from YachatsNews. Residential, single-family dwellings are experiencing the highest level of appreciation. In 2021, he wrote, the median sales price of single-family dwelling properties increased 24 percent, from $330,000 in 2020 to $410,000.

Some brokers, including Davies, said a lone promising sign in recent weeks is the slightest uptick in new inventory coming into the market. It’s difficult to discern why this mini-trend is taking hold she said, adding that it could be anything from a prospective buyer’s financing falling through to a house failing a key inspection.

Currently, Yachats has five active listings, she said, with asking prices ranging from $660,000 to $1.2 million. By comparison, Waldport has 14 active listings, Newport has 12 and Toledo has five.

Still, Davies said she just shakes her head when she has to sum up the local real estate market by saying, “You can’t buy much for half a million dollars.”

“I’ve said for way too long that this will ultimately implode because it’s just not sustainable,” she added. “But I’ve been wrong for awhile now so we’ll just have to wait and see.”

- Dana Tims is an Oregon freelance writer who contributes regularly to YachatsNews.com. He can be reached at DanaTims24@gmail.com

To read about housing studies under way in Yachats and Waldport, go here

To read a 2019 Lincoln County housing strategy report, go here

Fascinating article. It is a given that the price of housing is rising to due an increase in demand relative to what I might describe as “sparse” supply.

What has caused supply to be so limited? I think several factors are at play – some obvious and some not so obvious.

1) We are in a Covid-19 economy that has disrupted supply of key building components. The supply of labor has been affected by illness. Furthermore, shipping has been delayed and foreign economies that supply key hardware and materials have also been dealing with Covid-related workforce shortages. All of this has driven up the cost of construction and limited construction starts.

2) Sanctions on China and now on energy have boosted costs throughout the country. These costs are inflating the cost of building materials, limiting construction starts.

3) Living in a coastal environment means there is less land to build on. Thus the cost of undeveloped or partially developed land is rising. The article mentions that we are hemmed in by the oceans and bluffs that surround the coast. Here in Yachats I would add the huge Siuslaw forest to the south is for all intents and purposes a barrier that cannot be penetrated. So land is at a premium. And a previous article in Yachats News said that much of the land is, according to county standards, simply unsuitable for sewer and water.

4) Even though costs have risen, wages going back to 1970 have been relatively flat, meaning no real increase above the cost of inflation. With flat wages, the available yet sparse housing stock is less affordable. Furthermore, many aging workers have left the workforce due to the unavailability of “living wage” jobs. It is unlikely that these workers would relocate away from the coast.

5) It is open to debate as to whether people are moving for jobs as in the past. I would guess that the rate of these kinds of moves has fallen due to the costs involved. If this is true, then fewer people would leave the coast, affecting the supply of housing negatively.

As the article makes clear, there are buyers that want to purchase. Many are coming from urban markets where the cost of their housing has risen to the point they can afford to move and purchase on the coast. Houses here are actually affordable when compared to an urban market like Los Angeles or San Francisco. These folks are likely looking to retire and likely not interested in gainful employment. With supply tight because of the above reasons (and possibly more), those houses that are put on the market are swept up by these buyers.

One key buying segment will likely fall in the near future – those who need to finance their housing purchase. Interest rates are rising, and unless they have well-paying jobs, it is unlikely they will qualify for housing at these prices. The days when banks took non-qualified buyers and pushed them into adjustable rate mortgages or actively pursued the “sub-prime” market are over. Interest rates will have a dampening effect on sales. But how high and when real estate prices will be affected is anyone’s guess.

Interest rate increases also negatively affect business investing and therefore normally result in an increase in unemployment. If a recession is likely in the next 12 months (my view), it is also likely that demand for housing will fall. If it falls and layoffs result in more houses being put on the market in major markets like Los Angeles, the price of available housing will fall in those markets. And if those folks cannot then afford to move to the Oregon coast, Oregon coastal properties will fall as well.

While recessions may bring lower housing prices, the resulting decrease in the standard of living for many is certainly not desirable.

Real estate prices are on the rise throughout the state and nation. The fact that our coastal towns are experiencing increased housing prices isn’t big news. How is it that Lincoln County needs to “evaluate the impact of short term rentals on affordable housing?” Is the theory that home owners are going to lose money to rent their homes? If the cheapest house in Yachats is $660,000, is the expectation that home owners rent this house at a loss? There is no math that makes this house affordable to buy or rent. Eliminating short term rentals solves nothing. People will not rent their $500,000 homes for $800/month out of the kindness of their hearts to solve the affordable housing issue. The math on the mortgage just doesn’t work out. Affordable housing needs to be planned and implemented by the county, not by hoping the real estate market will cool or by putting the responsibility of affordable housing on home owners.