By QUINTON SMITH/YachatsNews.com

YACHATS – A worldwide financial services company has downgraded the Yachats Rural Fire Protection District’s bond credit rating, citing its weak governance and poor budget management.

The downgraded rating by Moody’s Investors Service has no immediate effect on the fire district’s $7.4 million in bonds passed by voters in 2017 to build a new main station, but it reflects one of the first outside views of the district’s administration and board.

“… absent meaningful revenue and expenditure realignment and improved budget management, the district’s structural imbalance will continue into fiscal 2023,” said the Moody’s report issued Sept. 1. “Governance is a key driver to the rating downgrade; poor budgetary management has resulted in sustained structural imbalance and increased cash flow borrowing, exacerbating the financial strain on the district’s small size of operations.”

The district has been struggling financially for 4-5 years and suffered its first levy defeat last November that would have dramatically turned around its finances. The district is taking another shot at a smaller levy in November and Moody’s said passage “will be critical to the district’s credit quality.”

Moody’s noted the district got one-time budget relief in 2021 when it sold its former downtown Yachats fire station and used $338,000 in proceeds from that to pay off bank loans used for monthly operating costs.

Because of last year’s first levy defeat, the district has returned to bank borrowing – drawing $60,000 this month to pay its bills. The borrowing will continue through November, when the district gets its annual infusion of property taxes.

Borrowing has ranged from $300,000 to $400,000 a year for the past 3-4 years – all paid back once property taxes arrive but then resuming in the late spring to make ends meet.

District administrator Frankie Petrick informed the board of the lower Moody’s rating at its bi-monthly meeting Monday. A synopsis of it was available on Moody’s website Sept. 8.

Longtime board member Ed Hallahan, who is the district’s treasurer, said the rating doesn’t affect the voter-approved bond, which was sold to institutions in 2017. It only affects any future bonds – which the district does not intend to seek, he said, and is only relevant to future investors.

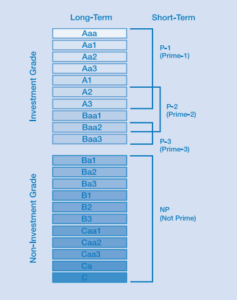

The district’s former bond credit rating was “Baa3” – the lowest of a 10 levels for investment grade bonds. The new “Ba1” is the highest of 11 levels of non-investment grade bonds.

Moody’s said the solution is voter approval of a new tax levy in November. Failure would force the district to continue borrowing, increasing its debt as costs continue to rise.

But the board has said if voters do not approve the levy Nov. 8 it could be forced to lay off three firefighters and cut ties to South Lincoln Ambulance, which holds the county contract for ambulance service in the Yachats area.

Details of district levies

The district is seeking a new, five-year tax levy of $1.59 per $1,000 of assessed property value in November and letting an existing levy of 59 cents expire. That means the net increase is $1 per $1,000 of assessed property value.

Voters soundly defeated a levy of the same amount last November – the first levy rejection in the district’s 73-year history — but it would have been in addition to an existing 59 cent levy. The board now hopes that by letting the smaller levy expire and doing a better job of campaigning voters will OK it.

The fire district relies on two levies and a permanent tax base to fund its yearly operating costs. Here’s how they work:

The district’s permanent tax base, established in 1997, is 29 cents per $1,000 assessed property value;

A three-year levy that started in 1999 carries a tax rate of 61 cents per $1,000 of assessed property value; it was last renewed in 2019 and the board intends to seek a renewal – and maybe a small increase – in May 2023;

A three-year levy that started in 2008 is 59 cents per $1,000; it was last approved in May 2018 but will be allowed to expire next June;

In total, the tax base and two levies add up to a tax rate of $1.49 per $1,000 assessed property value — or $447 a year on property assessed at $300,000.

If approved, the proposed $1.59 levy would take effect after the 59 cent levy expires, making the district’s overall tax rate $2.49 per $1,000 assessed property value. That would result in a property tax bill for the fire district of $747 per year – $300 more than it is currently – on property assessed at $300,000.

The district has two paid administrators, a part-time office clerk, and a budget for six paid firefighters. The district also provides staff for South Lincoln Ambulance, a nonprofit controlled by Petrick and assistant administrator Shelby Knife.

The district has struggled this year to fill a vacancy among its fire crews, relying on firefighters from other agencies to fill regular shifts. Petrick hired a firefighter/paramedic this month to fill a position being vacated by a firefighter/EMT – still leaving it one full-time employee short.

It may be time to think about re-staffing, as terrible as that sounds. Many businesses and non-profits have to do this regularly.

I will not be voting for any further levies as long as the present people remain.

If Moody’s a worldwide financial services company downgraded the Yachats Rural Fire Protection District’s (YRFPD) bond credit rating and cited its weak governance and poor budget management, then why should we taxpayers have any faith in the YRFPD and pass a new tax levy? In the first place, there has no mention from the Board/Chief of How, Where, and When they misspent the money. The taxpayers have asked for the information before and as of this date, it hasn’t been provided, to us. In any business, when you find problems in your company, you find first, the cause, then you find and complete the corrective action, then finally you find and implement the preventative action. None of that has been done by the YRFPD. If it has, then where are the written results and why have they not been provided to the citizens and taxpayers of the YRFPD. I have indicated this before, with all the money from the Federal and State governments that has been made available since pre-COVID times, why hasn’t the YRFPD asked for any of it? If they have then tell us who and when it was applied, for. Until I see more written and objective evidence that the YRFPD has changed its ways, I will continue to vote no on any new levies/property tax increases.

Building a “Taj Mahal” for a new fire station was bad financial planning from the get go. As long as the mismanagement continues in all forms over there, I’ll be voting no.

I could not have said it, better. I also believe and in my opinion, the entire fire station contract and all its expenses should be perused by the taxpayers or an outside entity contracted by us and outside of the purview of the Chief/The Board.