By QUINTON SMITH/YachatsNews.com

WALDPORT – Columbia Bank is selling – but not closing — its branch offices in Waldport and Newport as a proposed merger with Umpqua Bank nears completion.

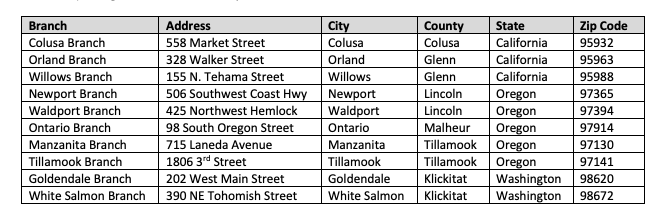

As part of the merger, proposed in 2021, the U.S.Department of Justice required Columbia to sell 10 of its 150 branches in Oregon, Washington and California to try to ensure a competitive marketplace. Two of those 10 are in Lincoln County.

Columbia Bank officials told YachatsNews they do not have a “signed agreement with a buyer” for either branches in Waldport or Newport. The future purchase would include everything from the furniture, to the buildings to deposits and loans.

Columbia Bank officials said the sale of its branches will not immediately affect a customer’s current accounts or services.

“There will be no interruption of services … when the buyer is identified,” said Chris Merrywell, executive vice president, and chief operating officer at Columbia Bank said in a statement through the bank’s public relations firm.

“Customers can continue banking at the Waldport and Newport branches,” Merrywell said. “The employees of both branches are expected to become employees of the new bank once a buyer is identified. Customers’ accounts and services will transition to those offered by the bank that purchases the branches.”

Merrywell said Columbia would let customers know of the sale and transition “as we have more information.”

“Once we have a signed agreement, we will share with customers the details and timelines surrounding the transition,” Merrywell said.

Columbia is based in Tacoma, Wash. and is buying Portland-based Umpqua Bank in an all-stock deal set to close late this year. Although Columbia is the acquirer, Umpqua will be the surviving brand, with the banking unit operating out of Portland and the Columbia State Bank holding company remaining in Tacoma with its name intact.

The combined company will oversee more than $50 billion in assets and $43 billion in deposits, and operate branches in California, Idaho, Nevada, Oregon and Washington.

Umpqua used to have a big branch just up the street from Columbia Bank in Waldport, but closed it in early 2019 because of declining business and gave the property valued at $600,000 to the city of Waldport, which now uses it as its city hall.

The Waldport branch is located in downtown at 425 Hemlock St., covers three tax lots and has a current real market value of $877,000 not including furnishings, according to the Lincoln County assessor’s office. It is not the first time the bank there has changed hands. It started as a branch of the Bank of Newport, changed to West Coast Bank when those banks merged in 2006, and then Columbia acquired the branch in 2013 when it bought West Coast Bank.

The Newport branch is located on 1.2 acres at the corner of U.S. Highway 101 and Alder Street and has a real market value of $3.91 million, according to county records.

Columbia Bank has four branches in Lincoln County. Branches in Depoe Bay and Lincoln City are not being sold. But it is selling two branches in Tillamook County – one in Manzanita and another in the city of Tillamook.

According to the FDIC’s latest figures, the Waldport branch has total deposits of $52.6 million and the Newport branch deposits of $123.4 million. Lincoln City has $58.3 million and Depoe Bay $40.2 million.

The Department of Justice’s agreement with Columbia and Umpqua also lays down restrictions what both have to do before and after the sale, including:

- Notify it if they close any branches in the counties where the branches were sold;

- Cannot impede the operation of the sold branches, especially anything that would cause a decrease in customers;

- May not reacquire any of the sold branches for at least five years;

- The two banks cannot transfer or dismiss the branch manager, assistant manager or loan officer before the sale;

- Must help with the transition of branch employees to the branch’s new owner; and,

- Must waive any non-complete clauses or may not require new non-complete clauses for the branch manager, assistant manager or loan officer.

Well I pray that instead of a different bank that it’s a credit union that comes here to serve all of us. I hate banks and all their charges, like they own us and we should be glad to pay them to serve us. All the while they are earning interest on our money. I know a lot of people that would love to have the luxury of a credit union in our town

I would agree with the credit union comment. I have been a member of a credit union for years and have never had a problem that wasn’t dealt with immediately.