QUINTON SMITH/YachatsNews.com

Most Yachats motel owners are strongly opposed to a proposed increase in the city’s lodging tax, contending that coupled with the city’s unusual food tax the city is putting too great a financial burden on tourists.

They are also critical of lack of communication between the City Council and businesses that fuel Yachats’ budget, and especially want the city to tackle parking problems downtown.

The City Council has scheduled a hearing Wednesday night on its proposal to raise the city’s transient lodging tax by one percentage point — from 9 to 10 percent. That’s an 11 percent increase. The state also tacks on a lodging tax of 1.8 percent, so if approved Yachats’ total lodging tax would be 11.8 percent.

Mayor John Moore estimates the increase would bring in an extra $115,000 a year – money needed to fund a growing city budget and pay for tourism-related projects needing an injection of cash.

But the majority of people who collect those taxes – now more than $1 million a year – want better and consistent communication on how the money is used on required tourism projects. And they warn that the city’s total taxes on tourists who stay and dine in Yachats – almost 17 percent — could be reaching a breaking point.

“I don’t think they should raise (the rate) until they use it more wisely,” said Linda Hetzler, owner of the Drift Inn, which in addition to its popular restaurant will have 20 motel rooms when an expansion is finished this month. “They should be more of a partner with businesses rather than just living off us.”

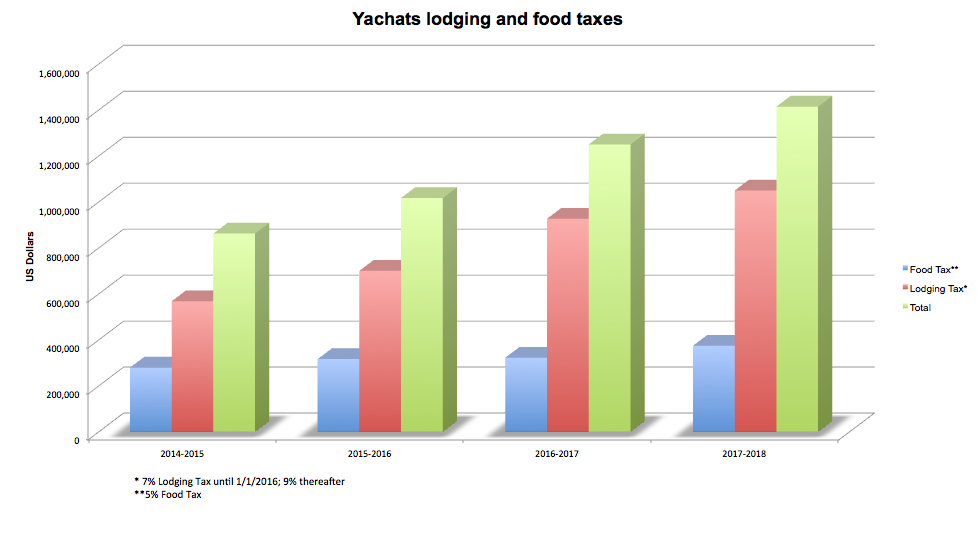

The city collected $1.04 million in lodging taxes in the 2017-18 fiscal year. That number has almost doubled in the last five years as tourism and motel rates increased, vacation rentals became more popular and because the city in 2016 raised its rate from 7 percent to 9 percent.

Motels contribute about 75 percent of that amount; vacation rentals the remaining 25 percent.

Yachats is also one of two cities in Oregon – the other is Ashland – to levy a food and beverage tax of 5 percent. That tax brought in $375,000 in 2017-18 and is used almost exclusively to pay for the sewage treatment plant and which has helped keep water and sewer rates from rising faster.

YachatsNews.com surveyed owners and managers of the six hotels and reached out to most of the vacation rental managers in the city. Scott Gordon, owner of the eight-room Ya-tel motel, was the only one with no objection to the proposed lodging tax increase, saying he feels Yachats “does an awful lot in service for visitors.”

“Now that food tax … people don’t complain about the size of it, but that there is one,” said Gordon, because Oregon is a non-sales tax state.

Hetzler said she has seen Drift Inn customers “practically eat my servers alive” when they see the food tax on their bill.

But the four people who own or manage the bulk of the city’s motel rooms — Hetzler, Drew Roslund, partner in the Overleaf and Fireside motels, Anthony Muirhead, general manager of the Adobe motel and restaurant, and Crystal Cooper, manager of the Yachats Inn — all said the city is in danger of taxing tourists too much.

“The best tax is one that someone else pays,” said Roslund, whose two motels rent 97 rooms and eight houses. “But I feel that I’m the one who has to represent the person who pays that tax.”

The background

Most Oregon cities – and all coastal cities and counties — have some kind of lodging tax ranging from 7 percent in Coos Bay to 10 percent in unincorporated Lincoln County. Florence is 9 percent; Lincoln City and Newport’s are 9.5 percent; Seaside and Waldport are 10 percent.

How governments use that money is, in part dictated by the state. Prior to 2016 local governments were required to use 30 percent of lodging taxes on tourist-related activities, which are broadly defined. The remaining 70 percent could be used for general government operations.

That formula flipped on July 1, 2016 with 70 percent of any new tax increase having to go to tourist-related activities and 30 percent for general government operations.

Last fiscal year, that total lodging tax in Yachats amounted to $1.04 million – up from $568,000 in 2014-15. The city’s yearly operating budget is $1.7 million.

With that 70-30/30-70 split on a 9 percent lodging tax, the city of Yachats now uses about 60 percent on general fund expenses and 40 percent on tourist-related activities.

In its current budget, Yachats has $203,000 slated to spend in its “city amenities” fund, including money for the library, Little Log Church Museum, the Commons, trails, new signs for the entrances to the city, and apportioned costs for professional services, maintenance and equipment.

The city has also budgeted $133,000 for marketing and amenities, including $65,000 to operate the Chamber of Commerce’s visitors center, marketing and website, professional services and city beautification.

Unspent in last year’s and this year’s budget is $200,000 for helping acquire and pave a city parking lot. There is also a cash carryover, or reserve, of $119,000.

After several meetings this winter, the city finance committee and mayor directed any proceeds from the tax increase to be focused on repairs to the Little Log Church, a proposed library expansion, and to help plan and fund an 804 Trail boardwalk along Ocean View Drive east from Yachats State Park to Highway 101.

Moore said the city’s budget committee last year received more requests for funding by the vacation amenities fund than it could afford.

“We can’t do them all,” he said.

Motel owners weigh in

Motel and vacation rental managers acknowledge that a 1 percentage point increase in lodging taxes alone will not likely deter many people from staying in Yachats. But they are critical that the city does little to recognize the impact of its 5 percent food and beverage tax when the taxes are added together.

“I absolutely think it’s important to be competitive,” said Muirhead, who wants to price the Adobe’s 110 rooms and two restaurants in the same range as those in Newport. “Eventually the economy is going to slow down and I don’t think Yachats wants to be the most expensive place on the coast. It’s a scary game to play with our visitors.”

Crystal Cooper, who manages the 36-room Yachats Inn for her father, Dale Marwood, is opposed to the proposed increase because it limits her flexibility on room rates. She is also critical, like Muirhead and Roslund, of spending tourist taxes on the library (“My customers don’t come to Yachats to use the library”), the need to improve off-season marketing and to find new events, especially to attract younger tourists.

“If lodging taxes have gone up a half million in the past few years I would have liked to have seen something more,” Cooper said. “It was 60 degrees here a lot in January and I didn’t see any promotion of that. I see billboards for Newport. I see billboards for Seaside. I see nothing for Yachats.”

Vacation rental managers have a different issue. In 2017, the City Council set a limit of 125 vacation rentals in Yachats, about 20 less than currently licensed. That has hurt the sale of houses licensed as vacation rentals and prevented adding more.

Jamie Michel, operations manager for Yachats-based Sweet Homes Vacation Getaways which has 75 houses along the coast, said they would be willing to endorse the tax increase if the city will consider changes when the ordinance comes up for review in September.

“We’re happy to help generate money for the community,” Michel said. “But we’d like to see them put some of the vacation rental restrictions back on the table. We’re frustrated that they cut back our revenue and in doing so also cut back theirs.”

Michel also points out that Yachats is the only jurisdiction she knows of that includes cleaning fees under its tax.

The Overleaf’s Roslund said the real effect of the proposed increase might be to get motel and vacation rental managers in Yachats to revive a dormant lodging association to communicate regularly with the City Council, to have a larger voice in and to better keep track of how tourist taxes are spent.

“I want to make sure that someone is holding the city’s feet to the fire to make sure they’re using the taxes appropriately,” Roslund said. “If it doesn’t meet state law on what it can be used for, I’ll fight it.”

Hetzler, who is also president of the Yachats Chamber of Commerce and of the local event company, Polly Plumb Productions, said businesses and the city could be better partners.

“Everyone has struggled a bit to communicate,” she said. “It can be addressed, but it will take time and energy.”

My experience as a library volunteer has been that visitors use the library to rent movies, borrow books, read the new papers, and use the computers and/or the free WiFi and conference table. Your customers “don’t come here for the library” but they do use it.