By Yachats News staff

More than 40,000 voters in Lincoln County have an interesting choice in front of them – do they raise taxes on folks other than themselves?

That’s the question they face on the ballot they received in the mail – do they vote to increase lodging taxes in unincorporated parts of the county by 20 percent to provide additional money for county park operations and improvements.

If approved by all county voters Nov. 7, the room tax rate for motels and vacation rentals in unincorporated areas of Lincoln County would be 12 percent, an increase of two percentage points from the current 10 percent rate.

County commissioners say their parks are chronically underfunded and that raising the lodging taxes is an appropriate way to help maintain and improve them.

The new rate would be equal to the lodging taxes currently charged by the cities of Newport, Lincoln City and Depoe Bay, but would be higher than the 10 percent tax in Waldport and 9 percent in Yachats. On top of all of those, there is also a 1.5 percent tax charged by the state of Oregon that goes to Travel Oregon, the state’s tourism-promotion agency.

But unlike cities, which can raise lodging taxes without asking voters, Lincoln County has to send the issue to the ballot. The county clerk’s office mailed nearly 40,500 ballots to registered voters last week.

County clerk Amy Southwell said the Nov. 7 special election is a small one, but with a countywide issue she expects 25 to 30 percent of voters could return their ballots.

Affects 530 properties

The proposed tax increase would affect just over 500 vacation rentals and approximately 30 hotels, motels, condominium complexes, RV parks and parks, county officials have said.

County officials estimate that the increase would raise an additional $568,605 a year with $398,000 of that dedicated to county parks. The remainder — $170,605 – would go into the county’s general fund for any type of use.

When county commissioners unanimously approved asking voters for the increase, commissioner Claire Hall said the county has had a lodging tax for 50 years and had only asked voters three times to increase it.

“We’re not guilty here of going to the well too often,” Hall said in August. “This is a good investment in local parks.”

The county collected $5.5 million in lodging taxes on motels and vacation rentals outside of cities in fiscal 2022-23 and without the 2 percentage point increase forecasts it will collect $5.8 million in fiscal 2023-24, which started July 1.

As required under previous ballot measures, the county directs portions of its lodging taxes to specific projects – the Oregon Coast Aquarium in Newport, county fair operations and projects, and for economic development. For the 2023-24 fiscal year the aquarium is expected to receive $435,000, economic development projects $580,000, and the fair $1.2 million, according to a budget worksheet provided to YachatsNews by the county’s finance office.

There is no active or organized opposition to the tax increase request. Via Oregon, a coalition of vacation rental owners that has fought with the county over limiting licenses, it not taking a position on the issue. Neither is the Oregon Restaurant and Lodging Association.

View the Future, a Yachats-based conservation group, paid for a letter of support in the voter’s pamphlet, saying the county needed to invest in its parks.

“As our central coast region continues to attract new residents, businesses, and visitors, county elected officials must have the financial resources to complement modest growth through the provision of publicly-accessible open space areas and recreational programs, as well as provide for the lasting stewardship of such areas,” the group said.

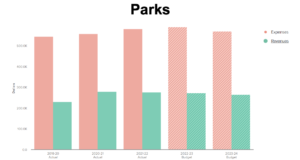

County parks

Lincoln County has 13 parks covering 333 acres ranging in size from from small boat launch/picnic areas to camping and day-use facilities. Three parks offer overnight camping.

It has an operations manager, Kelly Perry, who has been in the position for a year, and two maintenance workers.

“We just can’t keep up with maintenance,” Perry told YachatsNews in August. “Just to maintain what we have we have to start investing again.”

According to a budget presentation in May, there were 16,000 overnight stays in the three campgrounds last year and 3,000 boaters used the county-owned river launches.

There is little money in the park’s budget for capital improvements – just $16,500 budgeted this fiscal year. The county wants to develop a fourth campground – Brown Park – on the Siletz River but has no money to do that, Perry said, not even for matching grants.

County commissioners last month decided to use $100,000 from federal pandemic relief funds to create a digital reservation system for the parks and to build internet access at each

Before 2003 local governments that levied a lodging tax were required to use at least 30 percent of it on tourism promotion and activities or to build or operate visitor, convention or conference centers; the other 70 percent could be put into the category of general funds and used for operations of any kind. Oregon lawmakers established a statewide lodging tax in 2003 and at the same time flipped that local formula by requiring that at least 70 percent of any tax increase go to tourist-related activities and 30 percent for general government operations.

Under that 30-70/70-30 formula, Lincoln County currently uses 59 percent on general fund expenses and 41 percent on tourist-related activities.

Turnover of occupants plus the elevated level of use and neglect by visitors is more than reason enough to increase taxes on large scale properties that profit monetarily from having those parks available to tourists. It has been said, on more than one occasion, that Lincoln City needs a “facelift”. While I don’t think this was meant to apply to the parks, it certainly applies regardless .