By QUINTON SMITH/YachatsNews.com

Lincoln County has something else in the mail for you this week – your 2020 property tax bill.

Just eight days after sending out general election ballots, the county dropped some 49,000 property tax statements in the mail Friday. Your property tax statements should have arrived Monday or Tuesday.

Initial payments are due by Nov. 16. Full payments made by Nov. 16 receive a 3 percent discount and two-thirds payments receive a 2 percent discount.

Lincoln County assessor Joe Davidson said two-thirds of accounts are usually paid by Nov. 16, including 9,000 paid automatically by banks holding a taxpayer’s residential mortgage.

At least one-third payment must be received by Nov. 16 to avoid delinquent interest charges. For people making one-third payments, the second payment is due by Feb. 15, 2020, and the third payment by May 15, 2020.

While painful to most people, property tax statements are also a reasonable indicator of what’s going on in the real estate market – even though those indicators are a year behind actual real estate sales.

Countywide, the value of real property is up 6 percent in 2020 from 2019, Davidson said. The increase last year was 9 percent.

“2019 was a little bit more of a spike,” Davidson said. “This year we’re back down to that 6 percent pace. There’s still a lot of demand for housing and not a lot of inventory, especially in the working class category.”

In the Yachats area, real property values overall were up 5.8 percent; in Waldport they jumped 12.8 percent, Davidson said.

“Waldport had a number of sales in 2019 indicating a significant upward trend within city limits, particularly in the Township 13 and Ridgewood Acres subdivisions,” Davidson said. “These sales influenced the overall average market trend for the Waldport area. ”

Most property owners will see a typical 3 percent increase in their assessed value due to Measure 50 – a constitutional amendment approved by Oregon voters in 1997. The most common exception to that limit is new construction or re-development of property.

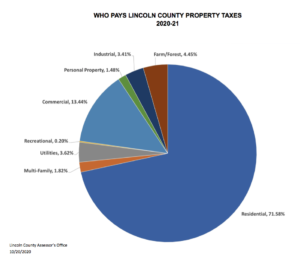

Countywide, total property taxes, fees and special assessments are up approximately 5.25 percent over last year to $129.6 million, Davidson said.

Davidson said there are 76 local taxing districts in Lincoln County, including education districts, health districts, city, county, port, local fire, water, road, special assessment districts and urban renewal districts. All of these have distinct tax rates, Davidson said, and most have different geographic boundaries, so overall tax rates for individual properties vary by location.

Total property taxes, fees and special assessments are up approximately 3.4 percent over last year, Davidson said.

Most property taxes are a product of assessed values and underlying district tax rates. Along with changes in assessed values, new voter-approved levies may impact total taxes in certain areas of the county, Davidson said.

This year, just one local option levy was approved in the county – for the Depoe Bay Rural Fire Protection District. There was one new taxing district created by Waldport-area voters this year – a road district for the Southeast Nelson Wayside area east of Waldport.

And for the third straight year there were no school, hospital district, port or fire district bonds approved by voters.

Tax statements display total amounts imposed by individual districts, along with current and prior year property values. Values for both years are categorized by land, structure, total real market value and total assessed value.

Davidson also reminded property owners in the Otis area of north Lincoln County that if they were a victim of the September wildfires to call (541-265-4102) or email (assessorinfo@co.lincoln.or.us) his office to see if adjustments may be made to property taxes to reflect the loss of assessed value.

Davidson said a common misperception is that property owners have to file an appeal in order to get an adjustment. Davidson said people can work with the assessor’s staff to get data to show real market data or to correct errors and possibly do value reductions by Dec. 31.

In 2017 the Board of Property Tax Appeals heard 130 appeals; the past two years had fewer than half of that, Davidson said.

Calling first to talk or making an appointment to visit seems to have helped the number of appeals, Davidson said.

“Don’t just appeal,” he said. Talk to us first.”